Deposit insurance is one of the benefits of having an account at an FDIC-insured bank. An FDIC-insured bank protects your money in the event of an unlikely bank failure. Keep reading to learn the benefits of being covered by an FDIC-insured bank.

What is FDIC Insurance?

FDIC insurance is a significant benefit of putting your money in a bank that is FDIC insured. “The standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category.” Simply banking with an FDIC-insured bank takes away having to purchase deposit insurance, as you are automatically covered. FDIC insurance maximizes your protection.

What Does FDIC Insurance Typically Cover?

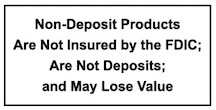

Just because a banking institution offers FDIC insurance, that does not necessarily mean all accounts, products, and investments are covered.

FDIC insurance often covers:

- Checking Accounts

- Savings Accounts

- Money Market Accounts

- Certificates of Deposits

The FDIC does not cover:

- Stock Investments

- Bond Investments

- Mutual Funds

- Annuities

- Safe Deposit Boxes

Remember if your bank is an FDIC-insured institution, coverage is automatic to you – there is no need to apply for FDIC insurance.

Are You Covered?

To find out if your deposits are insured, utilize the tools below to check if your bank is insured, which of your accounts are covered, and how much of your deposits are insured.

Is Your Bank Institution Insured? – Not all banks are FDIC insured. Mayville State Bank is!

Are Your Deposit Accounts Insured? – Not all accounts, products, and investments are covered by FDIC insurance.

How Much of Your Deposits Are Insured? Use EDIE or Electronic Deposit Insurance Estimator to determine how much is insured.